If everyone understands where funds are being allocated, they can better align their work with company priorities. Share your budgeting plan with your team and ask for feedback on ways it could be improved. A budget that lists out exactly how each dollar should be spent can also limit a company’s ability to be flexible with its needs. Too many details can make it difficult to see trends and categorize costs. While it is important to keep track of spending, budgets should be able to show you the big picture of how money is allocated. They can also help you see trends in projected versus actual income. Automated budgeting tools can improve the accuracy and efficiency of financial forecasts.

#Sample budget planning software

Automate your budgeting toolsĮnter all of your financial details into an application or software program to simplify your budget reporting.

As time goes on, you will get a more precise idea of your regular and one-time expenses.

At the beginning of a business, it is smart to have more money allocated to a flexible discretionary fund so that you can absorb unexpected costs. If you are creating a budget at the beginning of your business and don’t have past expenses to base it on, make estimates with room for flexibility.

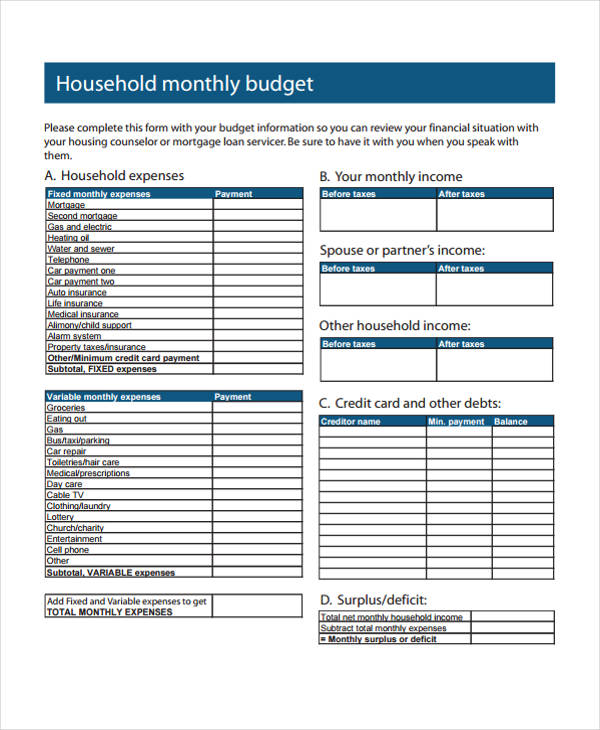

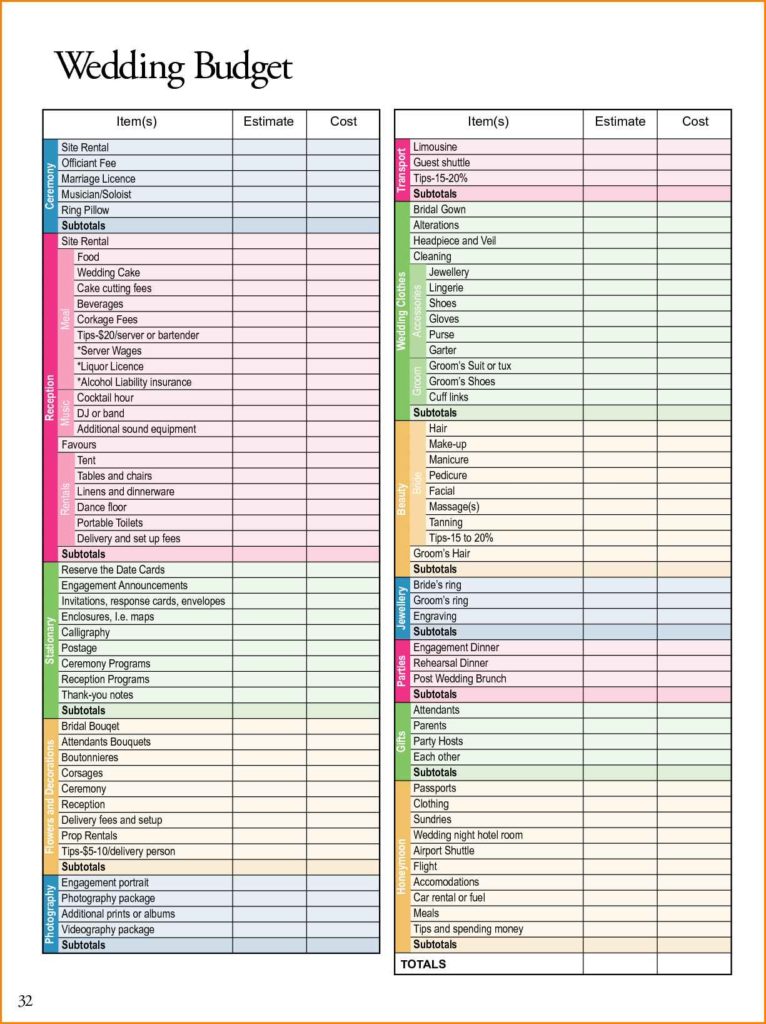

Subtract all expenses from income and make adjustments to have the desired amount of money left over. Include start-up costs and expected recurring bills. Make a list of all sources of income and expenses based on your business costs and earnings in previous budgeting periods. Follow these steps to create a budget that contributes to the success of your business: 1. Your budget can impact your financial success and overall organization as a business. Read more: Budget Management: Three Skills Essential for New Managers Best practices for creating a budget They provide benchmarks for long-term financial goals by breaking them down into short-term spending suggestions. Comparing actual spending to the projected budget can help you produce more accurate projections for future months, increasing your financial efficiency and optimizing profits. It restricts unnecessary spending and encourages managers to be strategic about purchases.īusiness budgets also communicate company priorities to staff, allocating funds to the most important parts of the business plan. They also identify how much money is available to invest back in the business and create a reliable estimate for future income, making sure that the company will not run out of money for operating expenses or future projects. They ensure that company money is being spent mindfully to support business goals, drive sales and secure employee benefits. Related: What Is Bottom-Up Budgeting? Why are budgets important?īudgets are the basis of a business’s action plan for financial decisions. They indicate how funds should be spent so that everyone with purchasing authority can coordinate their expenses. Budgets can be designed for a certain period of time, such as a monthly or yearly budget, or they can be dedicated to a certain event or project. It anticipates the resources different projects will need and determines where those funds will come from. What is a budget?Ī budget is a document that provides a plan for a business’s income and costs.

0 kommentar(er)

0 kommentar(er)